Modern Estate Tech

Death is Certain.

Probate is Optional.

Estate planning at API speed. AI-powered compliance meets financial verification meets attorney expertise.

Estate planning at API speed. AI-powered compliance meets financial verification meets attorney expertise.

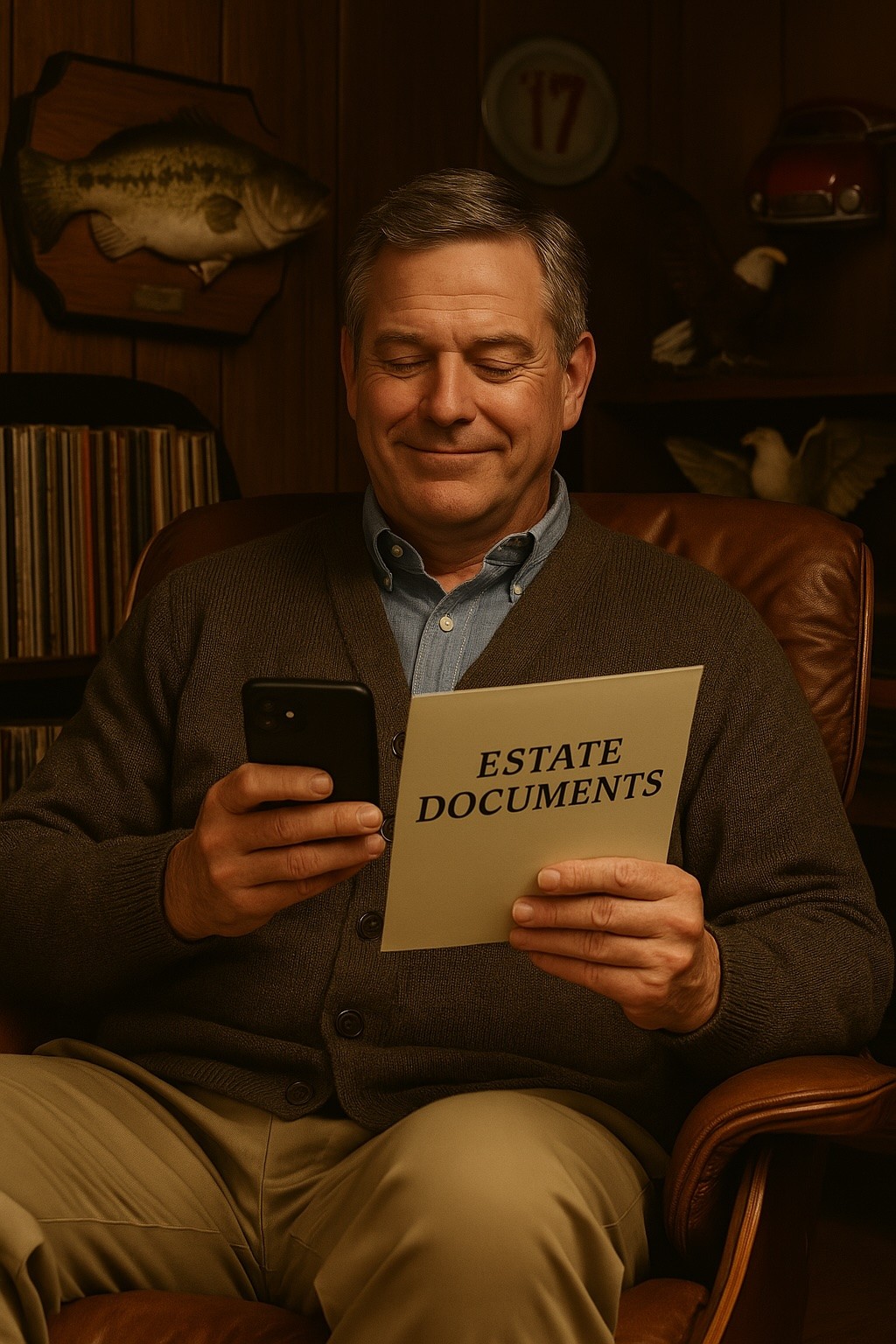

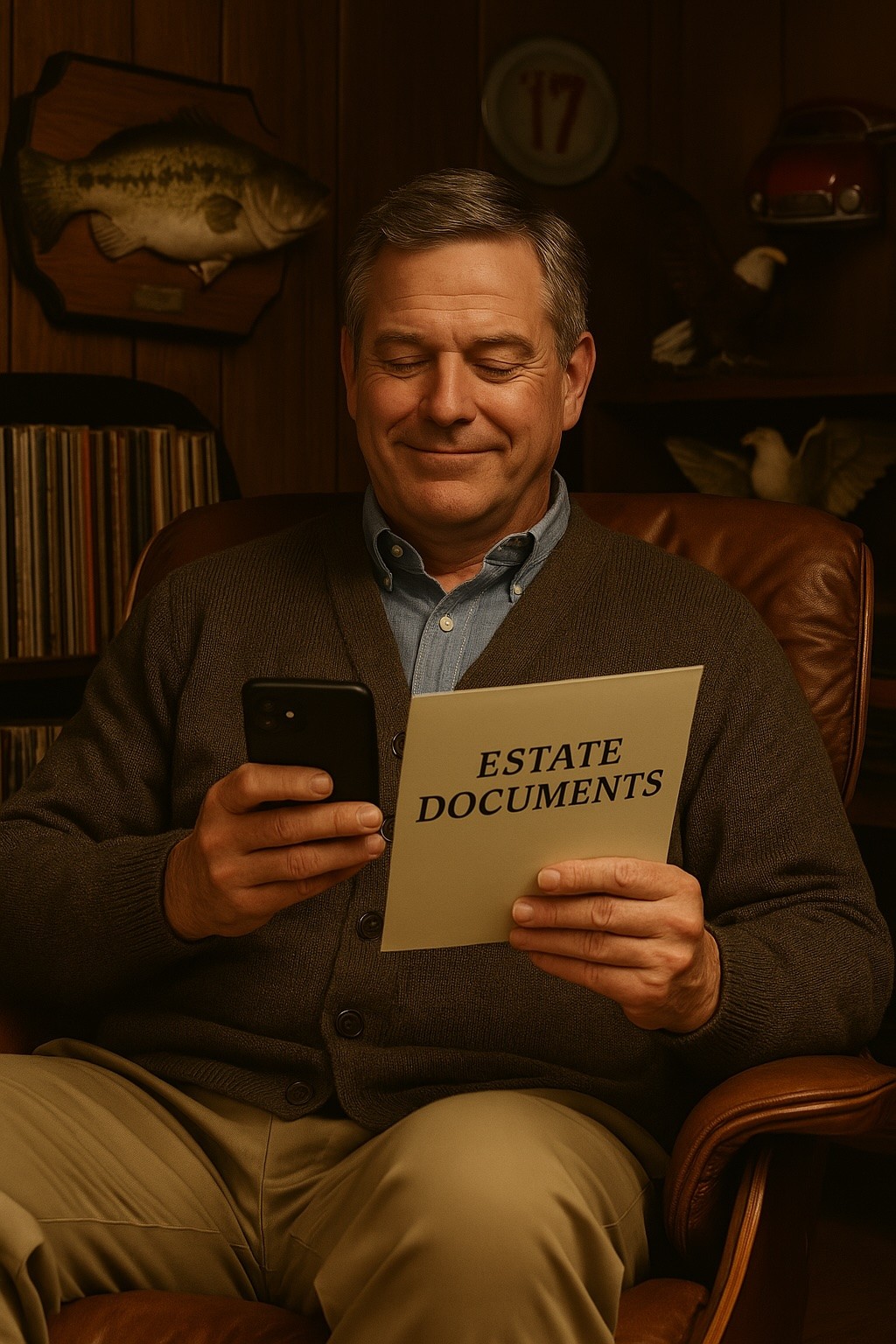

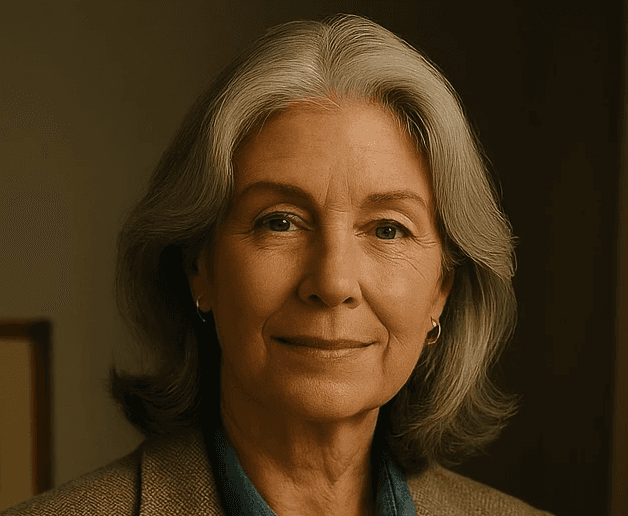

"This is what happens when you don't plan ahead. Death & Taxes users skip the drama and keep the inheritance."

Technology Platform

Technology Platform

Estate Planning Reimagined

We've built a platform that transforms estate planning from a dreaded chore into a streamlined digital experience. By combining AI compliance technology, financial data integration, and humor-based UX, Death & Taxes creates qualified leads for attorneys while solving the estate planning avoidance problem that affects 58% of Americans.

0%

0%

Americans Without a Plan

The majority of adults are unprepared for the inevitable, creating a massive market

0%

0%

Americans Without a Plan

The majority of adults are unprepared for the inevitable, creating a massive market

0%

0%

Americans Without a Plan

The majority of adults are unprepared for the inevitable, creating a massive market

$0T

$0T

State compliance

The largest generational wealth transfer in history is happening now

$0T

$0T

State compliance

The largest generational wealth transfer in history is happening now

$0T

$0T

State compliance

The largest generational wealth transfer in history is happening now

0K

0K

Estate Attorneys

Consumer journey from chatbot to attorney-ready estate plan

0K

0K

Estate Attorneys

Consumer journey from chatbot to attorney-ready estate plan

0K

0K

Estate Attorneys

Consumer journey from chatbot to attorney-ready estate plan

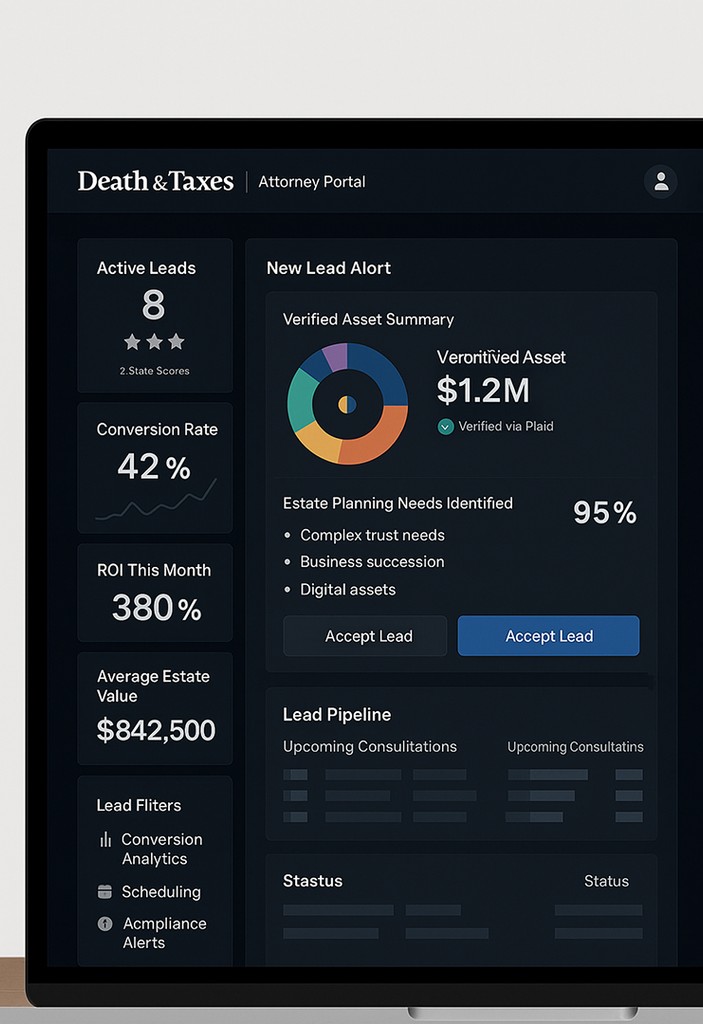

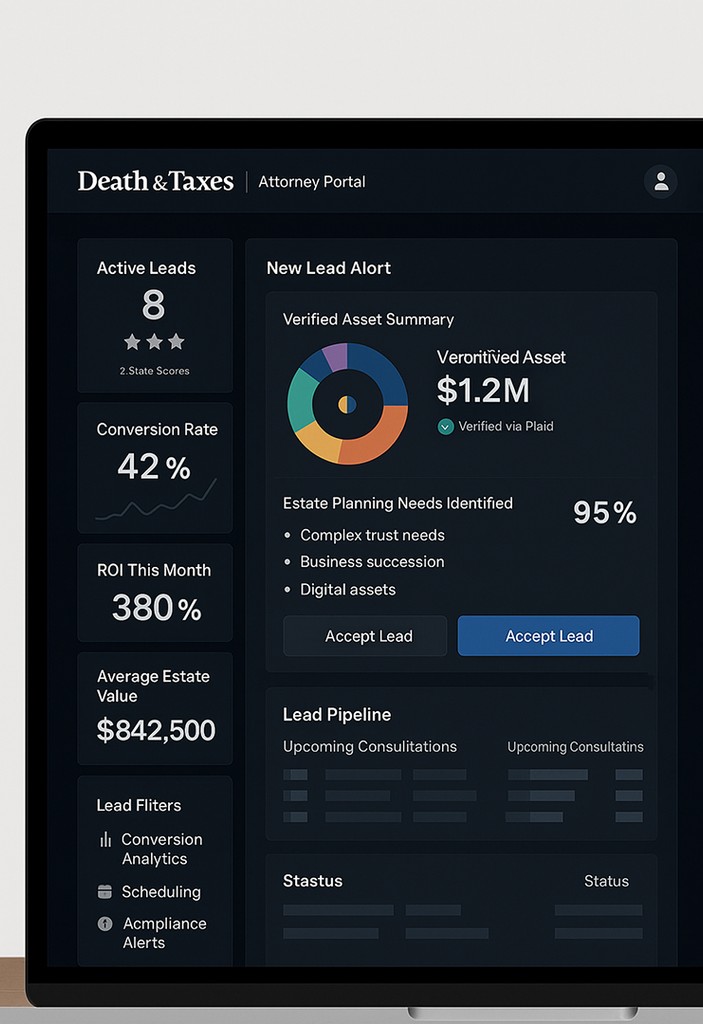

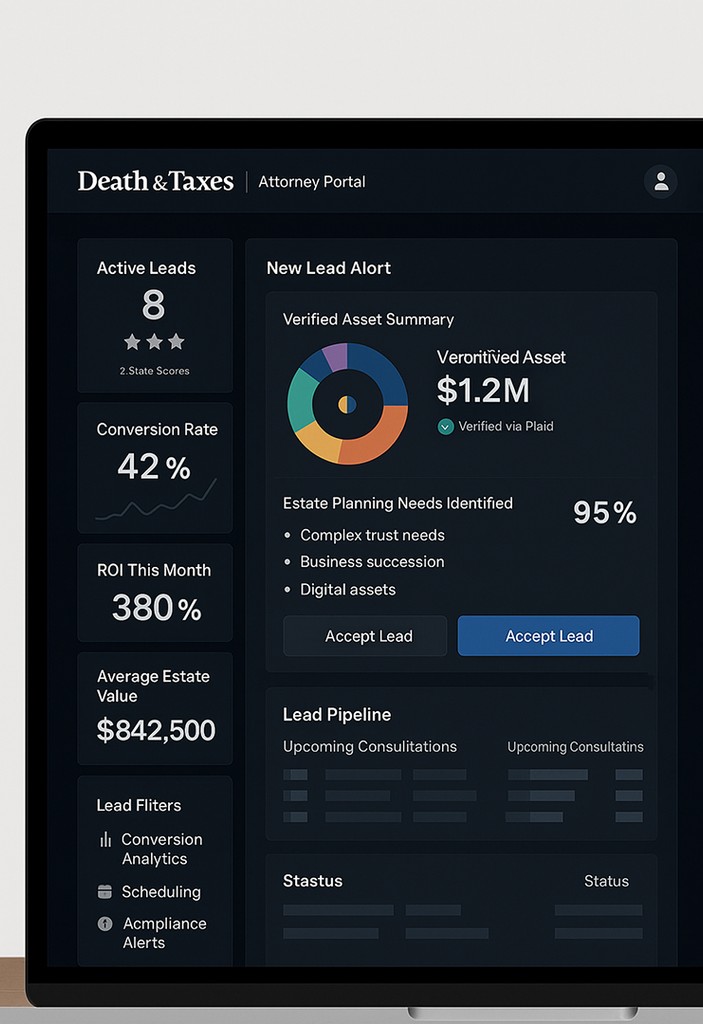

0%

0%

Conversion Boost

Every attorney lead includes verified assets and legal needs assessment

0%

0%

Conversion Boost

Every attorney lead includes verified assets and legal needs assessment

0%

0%

Conversion Boost

Every attorney lead includes verified assets and legal needs assessment

Services

Services

Two-Sided Estate Planning Marketplace

Transforming Estate Planning Through Technology

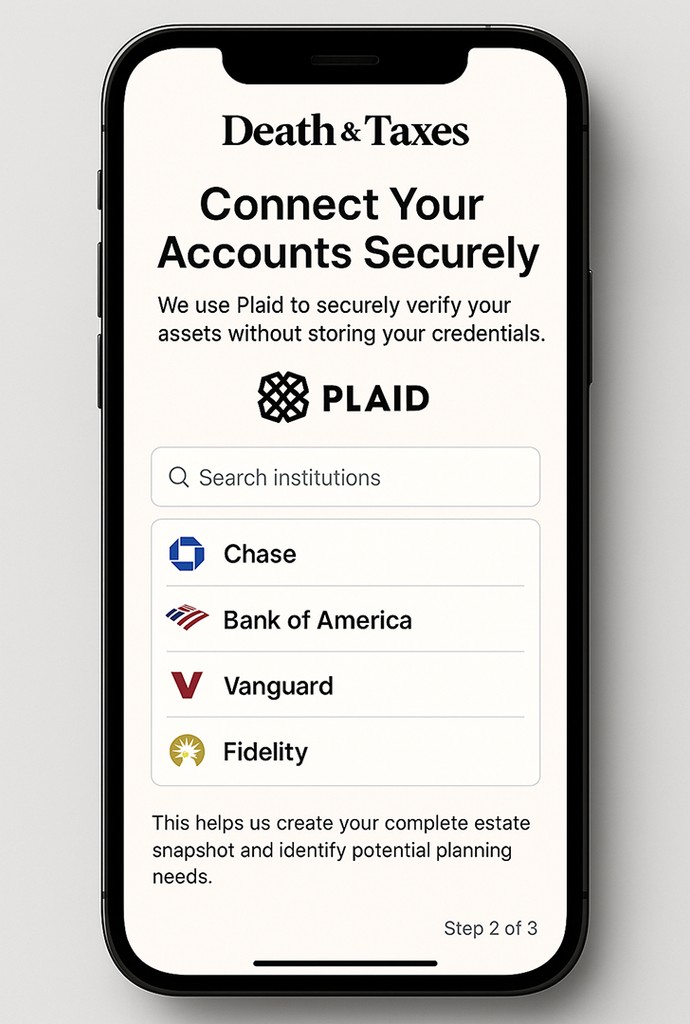

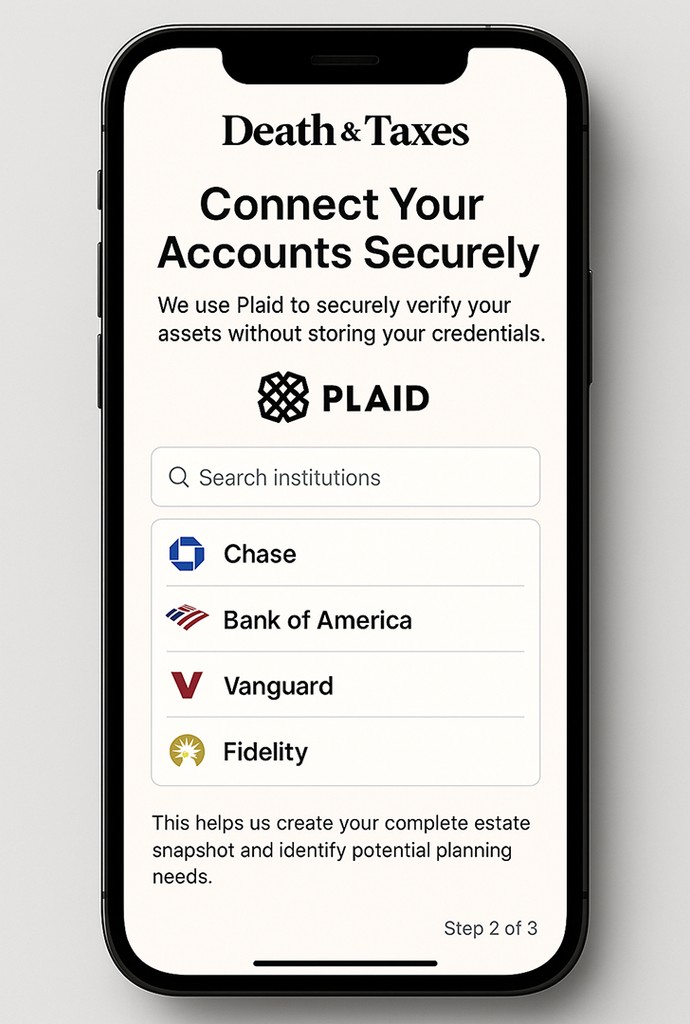

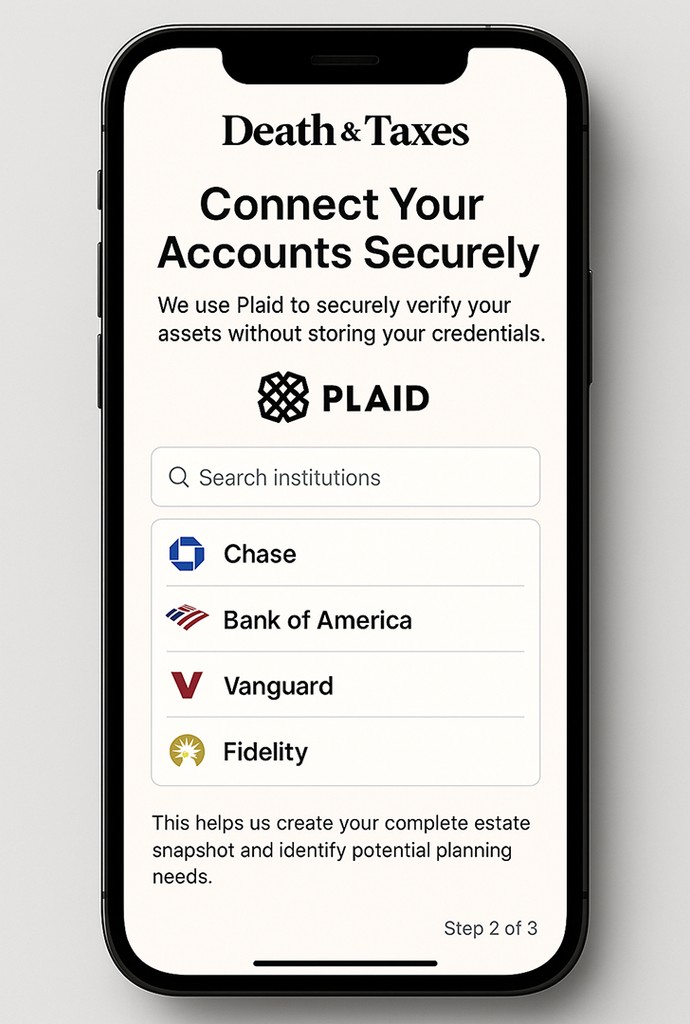

Financial X-Ray Vision

Automatically discovers and verifies all your assets in seconds. Even the ones you forgot about.

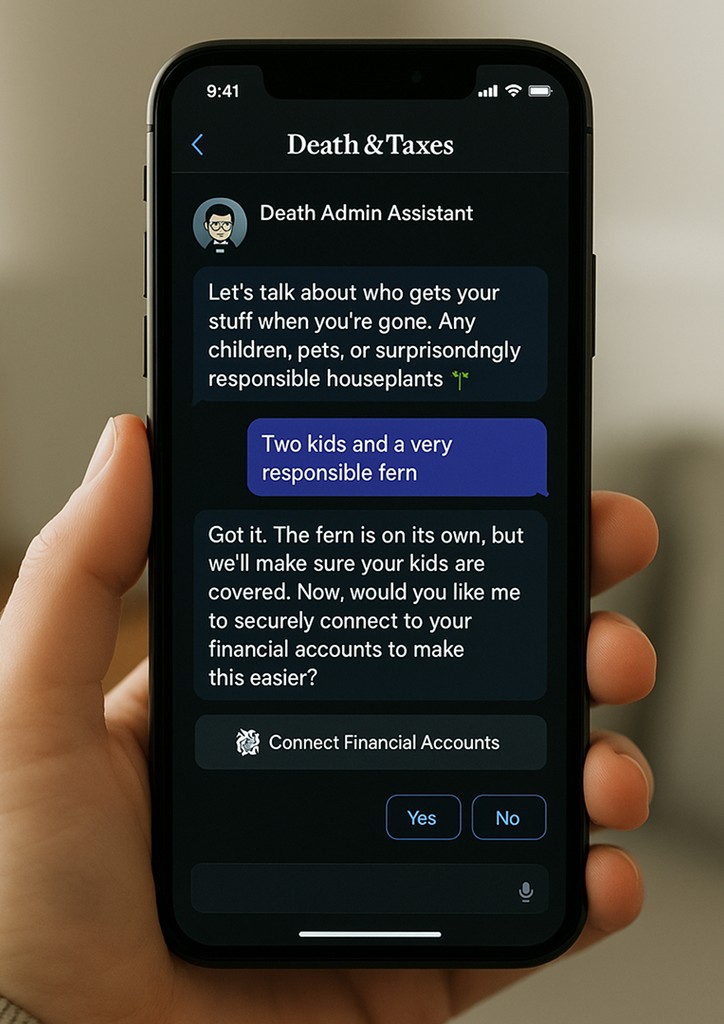

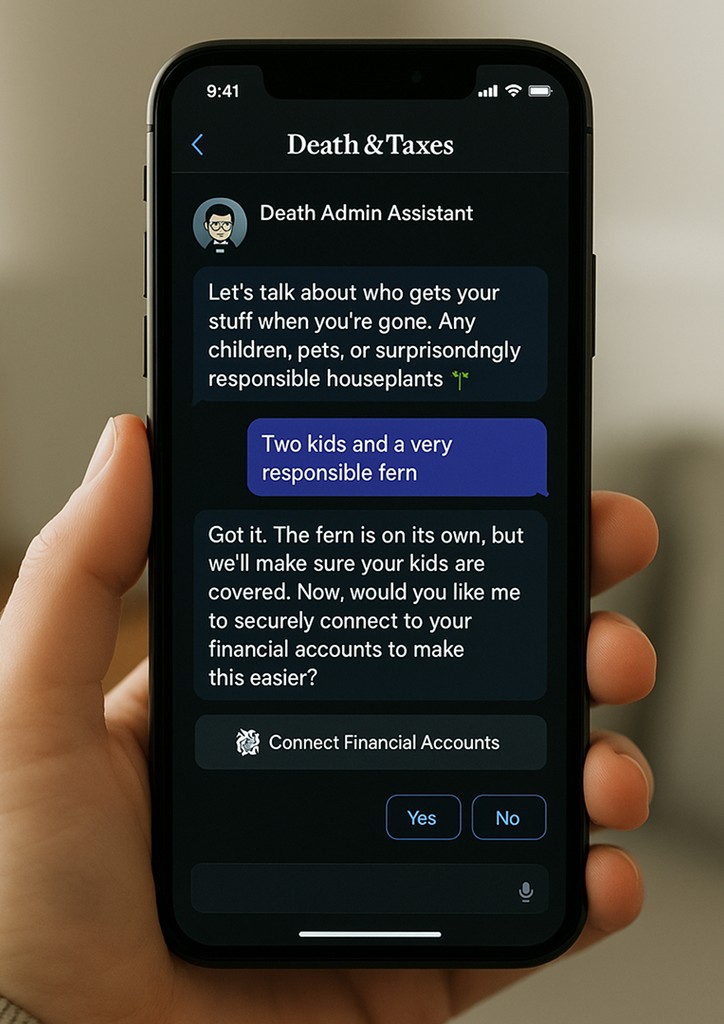

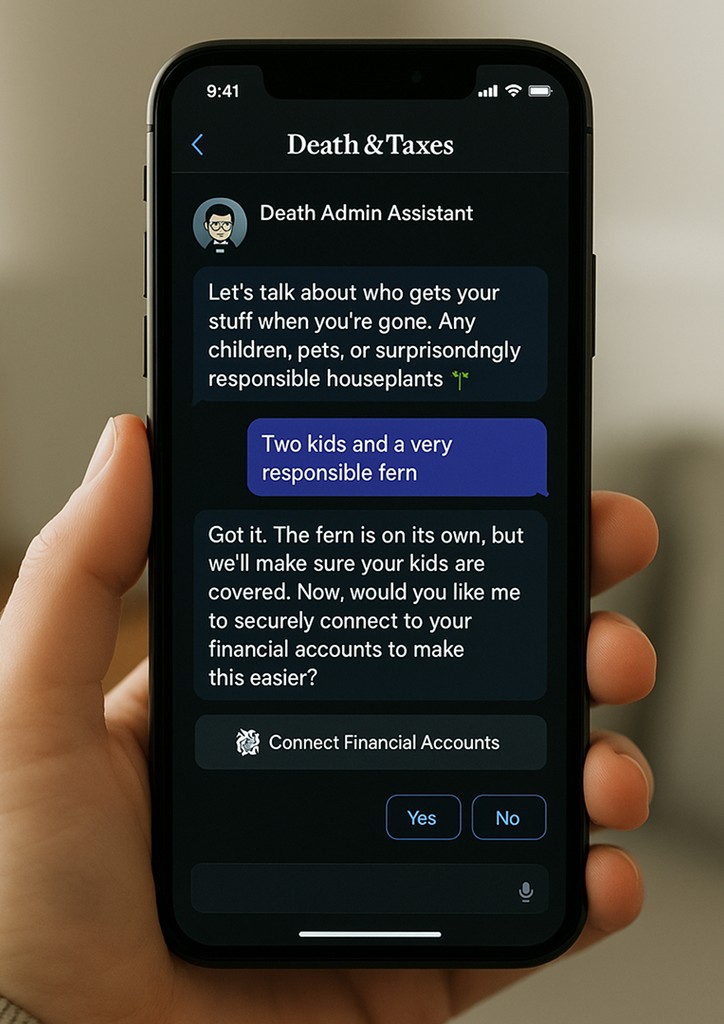

Death Admin Assistant

Have the uncomfortable conversations with our chatbot instead of your family. We'll ask the awkward questions so you don't have to.

Bank Level Security, Coffin Level Privacy

Connect your accounts without sharing passwords. Your financial secrets are safer with us than in your password manager named "password123."

For Attorneys

Pre-qualified leads with verified assets and specific estate planning needs already identified. Just solve, don't excavate.

Our work

Our work

Platform Experience

See how we’ve transformed homes with our expert craftsmanship and attention to detail.

For Millennials: Estate Planning Without the Eye Rolls

Estate planning designed for digital natives who have more passwords than physical assets. From cryptocurrency to streaming accounts, we protect what matters to you without the stuffy lawyer vibes. Complete your plan between TikTok scrolls.

Digital Natives

30 Minutes

I've put more thought into my Spotify playlists than my estate plan until now. Knocked it out while waiting for my cold brew."

Todd Crawford

For Millennials: Estate Planning Without the Eye Rolls

Estate planning designed for digital natives who have more passwords than physical assets. From cryptocurrency to streaming accounts, we protect what matters to you without the stuffy lawyer vibes. Complete your plan between TikTok scrolls.

Digital Natives

30 Minutes

I've put more thought into my Spotify playlists than my estate plan until now. Knocked it out while waiting for my cold brew."

Todd Crawford

For Millennials: Estate Planning Without the Eye Rolls

Estate planning designed for digital natives who have more passwords than physical assets. From cryptocurrency to streaming accounts, we protect what matters to you without the stuffy lawyer vibes. Complete your plan between TikTok scrolls.

Digital Natives

30 Minutes

I've put more thought into my Spotify playlists than my estate plan until now. Knocked it out while waiting for my cold brew."

Todd Crawford

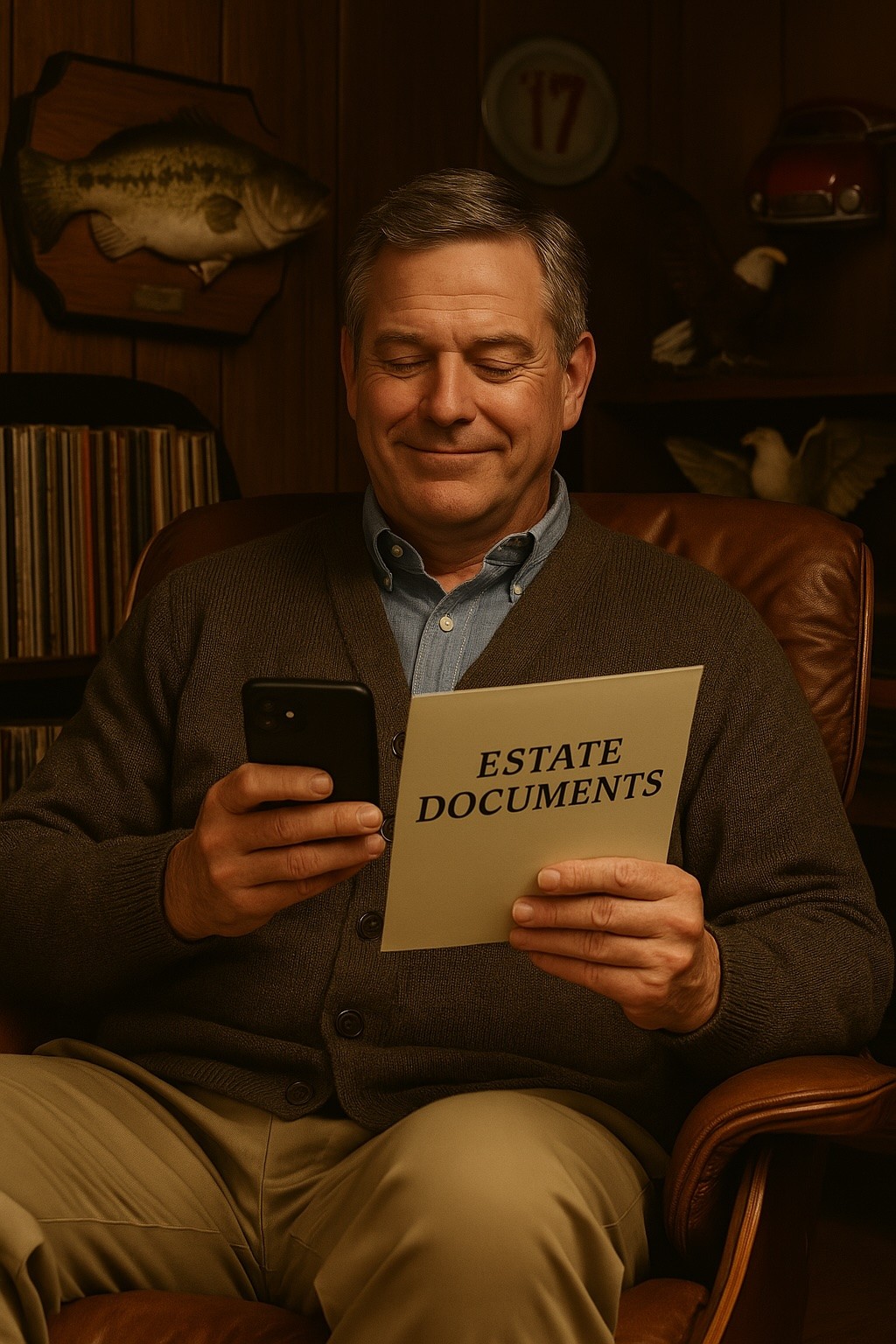

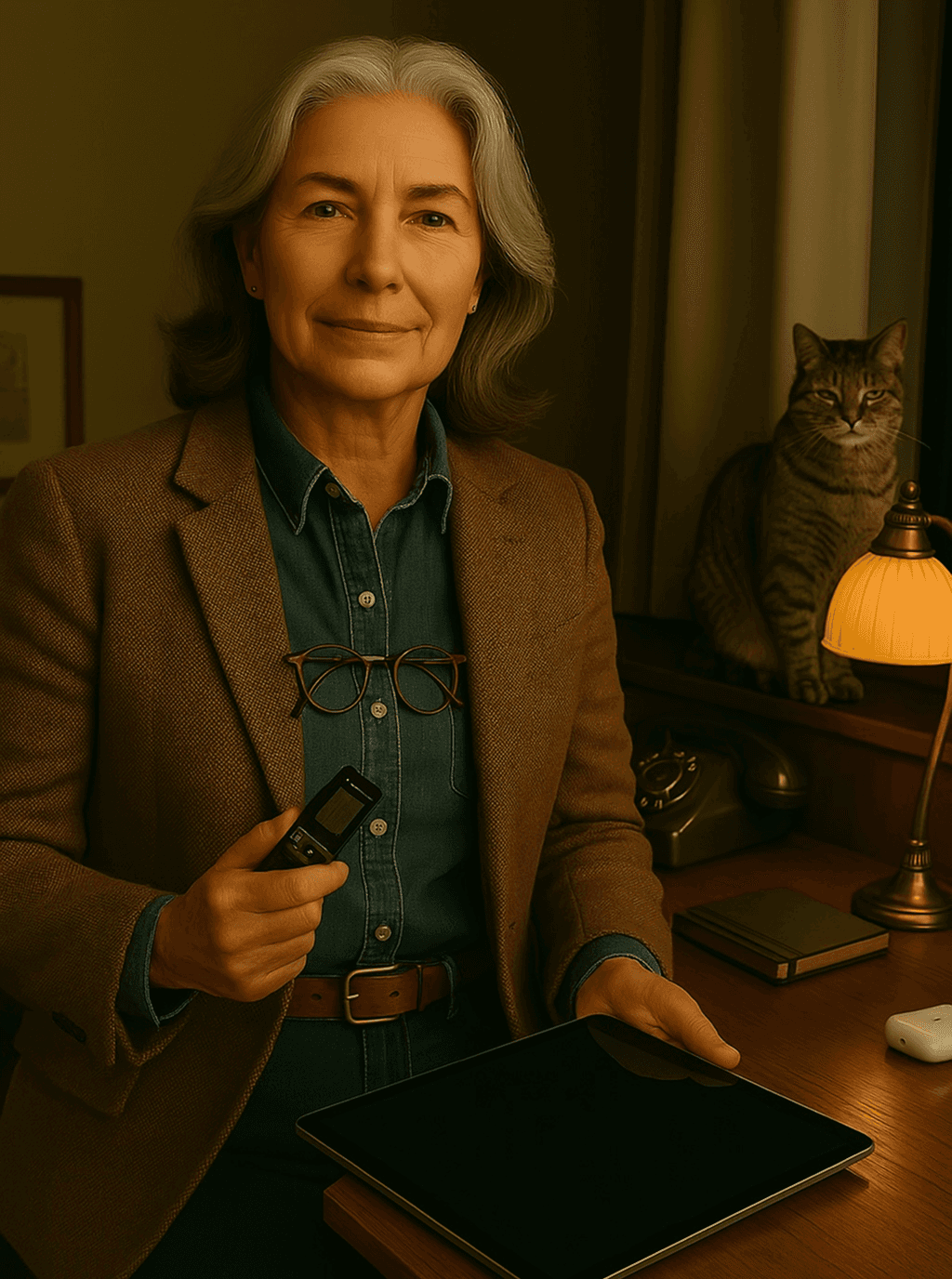

For Boomers: Protecting What You've Built

You've spent a lifetime building assets and memories. Our platform ensures they're protected and transferred according to your wishes, without endless attorney meetings or confusing paperwork. Digital simplicity with old-school protection.

Legacy Planning

45 Minutes

After three failed attempts at traditional estate planning, this platform finally made sense. My children will thank me – though they don't know it yet.

Michael Turner

For Boomers: Protecting What You've Built

You've spent a lifetime building assets and memories. Our platform ensures they're protected and transferred according to your wishes, without endless attorney meetings or confusing paperwork. Digital simplicity with old-school protection.

Legacy Planning

45 Minutes

After three failed attempts at traditional estate planning, this platform finally made sense. My children will thank me – though they don't know it yet.

Michael Turner

For Boomers: Protecting What You've Built

You've spent a lifetime building assets and memories. Our platform ensures they're protected and transferred according to your wishes, without endless attorney meetings or confusing paperwork. Digital simplicity with old-school protection.

Legacy Planning

45 Minutes

After three failed attempts at traditional estate planning, this platform finally made sense. My children will thank me – though they don't know it yet.

Michael Turner

Digital Asset Protection for the Modern Estate

From Bitcoin to Bored Apes to your Netflix password, your digital footprint needs protection too. Our platform secures, catalogs, and creates inheritance plans for assets that traditional attorneys don't even understand yet.

Crypto & NFTs

Future-Proof

My traditional lawyer asked if Bitcoin was 'one of those internet stocks.' Death & Taxes actually understood my crypto portfolio and how to protect it.

Laura Davies

Digital Asset Protection for the Modern Estate

From Bitcoin to Bored Apes to your Netflix password, your digital footprint needs protection too. Our platform secures, catalogs, and creates inheritance plans for assets that traditional attorneys don't even understand yet.

Crypto & NFTs

Future-Proof

My traditional lawyer asked if Bitcoin was 'one of those internet stocks.' Death & Taxes actually understood my crypto portfolio and how to protect it.

Laura Davies

Digital Asset Protection for the Modern Estate

From Bitcoin to Bored Apes to your Netflix password, your digital footprint needs protection too. Our platform secures, catalogs, and creates inheritance plans for assets that traditional attorneys don't even understand yet.

Crypto & NFTs

Future-Proof

My traditional lawyer asked if Bitcoin was 'one of those internet stocks.' Death & Taxes actually understood my crypto portfolio and how to protect it.

Laura Davies

CAUTIONARY TALES

CAUTIONARY TALES

Hear From Probate Survivors

Real stories from people who learned about estate planning the hard way

My dad's Bitcoin died with him. Now his digital fortune sits in crypto heaven while I eat ramen. Password management: not just for Netflix.

Emily Carter

Mom's will said 'divide everything equally.' Six lawyers, four therapists, and two restraining orders later, we're still fighting over her ceramic frog collection.

James Richardson

The IRS took more of grandma's estate than she spent on QVC in 30 years. And that woman bought EVERYTHING on QVC.

Sophie Williams

Took longer to settle dad's estate than it took him to build his entire real estate empire. Pretty sure his attorney's kids are now attending Harvard on our inheritance.

Daniel Foster

Found out I inherited aunt Betty's timeshare in Boca. Also inherited her timeshare maintenance fees, property taxes, and mandatory renovation costs. Thanks for the 'gift' that keeps on taking!

Charlotte Harris

Pro tip: Estate planning isn't the place to surprise everyone. Found out Dad had a second family when they showed up at the will reading. Christmas is super awkward now.

Oliver Bennett

Pro tip: Estate planning isn't the place to surprise everyone. Found out Dad had a second family when they showed up at the will reading. Christmas is super awkward now.

Oliver Bennett

Found out I inherited aunt Betty's timeshare in Boca. Also inherited her timeshare maintenance fees, property taxes, and mandatory renovation costs. Thanks for the 'gift' that keeps on taking!

Charlotte Harris

Took longer to settle dad's estate than it took him to build his entire real estate empire. Pretty sure his attorney's kids are now attending Harvard on our inheritance.

Daniel Foster

The IRS took more of grandma's estate than she spent on QVC in 30 years. And that woman bought EVERYTHING on QVC.

Sophie Williams

Mom's will said 'divide everything equally.' Six lawyers, four therapists, and two restraining orders later, we're still fighting over her ceramic frog collection.

James Richardson

My dad's Bitcoin died with him. Now his digital fortune sits in crypto heaven while I eat ramen. Password management: not just for Netflix.

Emily Carter

My dad's Bitcoin died with him. Now his digital fortune sits in crypto heaven while I eat ramen. Password management: not just for Netflix.

Emily Carter

Mom's will said 'divide everything equally.' Six lawyers, four therapists, and two restraining orders later, we're still fighting over her ceramic frog collection.

James Richardson

The IRS took more of grandma's estate than she spent on QVC in 30 years. And that woman bought EVERYTHING on QVC.

Sophie Williams

Took longer to settle dad's estate than it took him to build his entire real estate empire. Pretty sure his attorney's kids are now attending Harvard on our inheritance.

Daniel Foster

Found out I inherited aunt Betty's timeshare in Boca. Also inherited her timeshare maintenance fees, property taxes, and mandatory renovation costs. Thanks for the 'gift' that keeps on taking!

Charlotte Harris

Pro tip: Estate planning isn't the place to surprise everyone. Found out Dad had a second family when they showed up at the will reading. Christmas is super awkward now.

Oliver Bennett

My dad's Bitcoin died with him. Now his digital fortune sits in crypto heaven while I eat ramen. Password management: not just for Netflix.

Emily Carter

Mom's will said 'divide everything equally.' Six lawyers, four therapists, and two restraining orders later, we're still fighting over her ceramic frog collection.

James Richardson

The IRS took more of grandma's estate than she spent on QVC in 30 years. And that woman bought EVERYTHING on QVC.

Sophie Williams

Took longer to settle dad's estate than it took him to build his entire real estate empire. Pretty sure his attorney's kids are now attending Harvard on our inheritance.

Daniel Foster

Found out I inherited aunt Betty's timeshare in Boca. Also inherited her timeshare maintenance fees, property taxes, and mandatory renovation costs. Thanks for the 'gift' that keeps on taking!

Charlotte Harris

Pro tip: Estate planning isn't the place to surprise everyone. Found out Dad had a second family when they showed up at the will reading. Christmas is super awkward now.

Oliver Bennett

My dad's Bitcoin died with him. Now his digital fortune sits in crypto heaven while I eat ramen. Password management: not just for Netflix.

Emily Carter

Mom's will said 'divide everything equally.' Six lawyers, four therapists, and two restraining orders later, we're still fighting over her ceramic frog collection.

James Richardson

The IRS took more of grandma's estate than she spent on QVC in 30 years. And that woman bought EVERYTHING on QVC.

Sophie Williams

Took longer to settle dad's estate than it took him to build his entire real estate empire. Pretty sure his attorney's kids are now attending Harvard on our inheritance.

Daniel Foster

Found out I inherited aunt Betty's timeshare in Boca. Also inherited her timeshare maintenance fees, property taxes, and mandatory renovation costs. Thanks for the 'gift' that keeps on taking!

Charlotte Harris

Pro tip: Estate planning isn't the place to surprise everyone. Found out Dad had a second family when they showed up at the will reading. Christmas is super awkward now.

Oliver Bennett

My dad's Bitcoin died with him. Now his digital fortune sits in crypto heaven while I eat ramen. Password management: not just for Netflix.

Emily Carter

Mom's will said 'divide everything equally.' Six lawyers, four therapists, and two restraining orders later, we're still fighting over her ceramic frog collection.

James Richardson

The IRS took more of grandma's estate than she spent on QVC in 30 years. And that woman bought EVERYTHING on QVC.

Sophie Williams

Took longer to settle dad's estate than it took him to build his entire real estate empire. Pretty sure his attorney's kids are now attending Harvard on our inheritance.

Daniel Foster

Found out I inherited aunt Betty's timeshare in Boca. Also inherited her timeshare maintenance fees, property taxes, and mandatory renovation costs. Thanks for the 'gift' that keeps on taking!

Charlotte Harris

Pro tip: Estate planning isn't the place to surprise everyone. Found out Dad had a second family when they showed up at the will reading. Christmas is super awkward now.

Oliver Bennett

THINGS YOU'RE TOO AFRAID TO ASK

THINGS YOU'RE TOO AFRAID TO ASK

Investor Questions We've Actually Thought About

Investor Questions We've Actually Thought About

Investor Questions We've Actually Thought About

Still haunted by unanswered questions? We won't ghost you like your estate plan has.

Still haunted by unanswered questions? We won't ghost you like your estate plan has.

Still haunted by unanswered questions? We won't ghost you like your estate plan has.

Is the market really that big?

$27.5B annually, with 147M Americans lacking proper plans and 40,000+ attorneys who need better leads. That's bigger than the entire US coffee shop industry, with fewer jittery side effects.

How do you actually make money?

Attorney lead fees ($45-350 per lead based on estate size), platform partnerships (we take 15-25% for sending business their way), and subscription dashboards for attorneys ($99-349/month). Multiple streams, no rivers of tears.

Why can't someone just copy this?

Our three-moat defense: proprietary AI trained on legal quirks in 50 states, financial API integration that actually works, and a brand voice that doesn't sound like it was written by the Grim Reaper's accountant.

How do you get customers?

Financial platform partnerships, marketing that doesn't put people to sleep, and attorney networks that spread faster than gossip at a family reunion.

Those growth projections seem aggressive?

We're targeting $120M ARR by Year 5 with 38% margins. For comparison, LegalZoom hit $100M with worse tech and marketing so boring it could sedate a horse.

What happens next?

First 15 states, then all 50, then Canada (they're just like us but politer about death), then specialized services for digital assets and ongoing monitoring.

Is the market really that big?

$27.5B annually, with 147M Americans lacking proper plans and 40,000+ attorneys who need better leads. That's bigger than the entire US coffee shop industry, with fewer jittery side effects.

How do you actually make money?

Attorney lead fees ($45-350 per lead based on estate size), platform partnerships (we take 15-25% for sending business their way), and subscription dashboards for attorneys ($99-349/month). Multiple streams, no rivers of tears.

Why can't someone just copy this?

Our three-moat defense: proprietary AI trained on legal quirks in 50 states, financial API integration that actually works, and a brand voice that doesn't sound like it was written by the Grim Reaper's accountant.

How do you get customers?

Financial platform partnerships, marketing that doesn't put people to sleep, and attorney networks that spread faster than gossip at a family reunion.

Those growth projections seem aggressive?

We're targeting $120M ARR by Year 5 with 38% margins. For comparison, LegalZoom hit $100M with worse tech and marketing so boring it could sedate a horse.

What happens next?

First 15 states, then all 50, then Canada (they're just like us but politer about death), then specialized services for digital assets and ongoing monitoring.

Is the market really that big?

$27.5B annually, with 147M Americans lacking proper plans and 40,000+ attorneys who need better leads. That's bigger than the entire US coffee shop industry, with fewer jittery side effects.

How do you actually make money?

Attorney lead fees ($45-350 per lead based on estate size), platform partnerships (we take 15-25% for sending business their way), and subscription dashboards for attorneys ($99-349/month). Multiple streams, no rivers of tears.

Why can't someone just copy this?

Our three-moat defense: proprietary AI trained on legal quirks in 50 states, financial API integration that actually works, and a brand voice that doesn't sound like it was written by the Grim Reaper's accountant.

How do you get customers?

Financial platform partnerships, marketing that doesn't put people to sleep, and attorney networks that spread faster than gossip at a family reunion.

Those growth projections seem aggressive?

We're targeting $120M ARR by Year 5 with 38% margins. For comparison, LegalZoom hit $100M with worse tech and marketing so boring it could sedate a horse.

What happens next?

First 15 states, then all 50, then Canada (they're just like us but politer about death), then specialized services for digital assets and ongoing monitoring.

Ready To Talk About Death?

Ready To Talk About Death?

Let's Talk About This Morbidly Attractive Opportunity

Want to get in on the ground floor of making death admin less painful than a paper cut? Our founding team is standing by to walk you through our platform, growth plans, and how we're bringing estate planning into this century.

Office

1040 Inevitable Lane, Suite 1776 Phoenix, AZ 85001

167-169 Great Portland Street,

W1W 5PF

Telephone

888-DEAD-PDQ